What is the Importance of investment for future?

What are necessary precautions for students before investment?

What is the minimum investment required to be a student in a good institute?

What are the Top 4 investment areas for students?

Where are the best areas to invest in student property in 2022?

Where to invest in student accommodation?

What are the best investment options for a college student?

Where to invest in student property in Liverpool and Manchester?

Top 4 investment areas for students

WHAT ARE TOP 4 AREAS where student can invest is a guide that will make you able to know the major fields where you can invest your money being student. It is important because this is directly depending upon the future of investor. Major fields will play a significant role because that are responsible to generate profit. So let us have a look upon the top 4 areas where students can invest easily and also can secure future.

Precautions for students before investment

Being a student, You should create a budget if you still need to get one to keep track of your spending. Calculate the remaining funds after paying for essentials like rent, utilities, phone, cable, food, and other costs. If you are working, your salary should provide relief in Money for entertainment, clothing, and excursions.

After that, you can set aside money for savings. It is also an advisor for you to put your emergency fund, which should have enough money to cover your living expenses for six months, at the top of your priority list. You can start investing some of your savings after creating a safety net.

Top 4 areas where student can invest

There are four main areas where student can invest easily

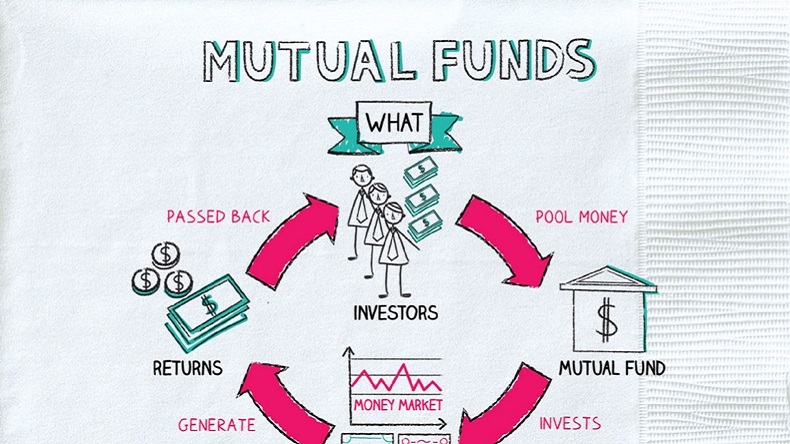

Investing in mutual funds

By combining funds from various investors, mutual funds make investments in stocks, bonds, and other assets. The Money is used to buy the particular stocks, bonds, and other assets that make up the “portfolio.” The criteria for the portfolio may include a particular sector (like technology or healthcare), a particular risk level (growth vs. value), or even a particular time frame. A money manager chooses and modifies the assets in their portfolio to maximize returns for investors. The professional management of the investments is subject to fees.

Student can invest in bonds

Bonds are loans given by investors to borrowers, such as businesses. We pay for business expenses with the Money you “loaned.” On their initial investment, the investor continues to earn interest. A well-balanced portfolio should include bonds because they can lessen the impact of declining stock prices.

Mutual fund indexes

An index fund is a group of securities that are connected to a particular index; Since there is no requirement for a professional to choose the stocks or bonds, index funds are frequently less expensive. Because “dividends are automatically reinvested, you can set up automatic recurring purchases, and you put some money into it,” index funds are advised to students.

The initials ETF stand for exchange-traded fund.

ETFs are asset collections that, like mutual funds, are used to track a particular index, industry, commodity, or asset. You could, for instance, have an ETF that tracks corporate bonds or real estate. Bombardier advises students to invest in inexpensive, well-diversified ETFs that give them access to many stocks without requiring them to research each one individually.

The final decision you must make is where to begin investing. After selecting, decide whether you want to invest in funds or specific assets such as stocks. Instead of blindly following one expert, consider them your board of directors. You consider their advice, conduct your research, and reach your conclusions.

Remember that you are the only one who has control over your finances. With great power comes great responsibility. It is possible to make a lot of money, but it is also possible to lose it. So, be wise. You will learn as you go. Keep in mind that no one is perfect. Then sit back and watch your money grow!

One comment

Comments are closed.